How I Saved $100,000 By 30

A couple of months after celebrating my 30th birthday, I celebrated a financial milestone that I didn’t think I would achieve by that age – having $100,000 saved up.

I feel simultaneously proud and self-conscious writing about this milestone. Proud because it’s a pretty damn good achievement in my books. On the other hand, self-conscious because it doesn’t feel like that big of a deal when so many others have gotten to this number (or higher) quicker than I have.

Because if you’ve read enough personal finance articles, you’ll know that saving $100,000 by 30 isn’t a new concept, and I suppose my perception has been skewed from reading too many of those articles.

But outside the personal finance echo chamber, I’ve met enough people who feel that it’s impossible to save, let alone save $100,000. So perhaps there’s merit in sharing my own journey to $100,000 if it helps someone else get there too.

In this article, I’ll cover the following things:

- Why saving $100k is even a goal people want to achieve

- All the things that went right to help me save $100k (because it’s not just about effort, it’s about luck too)

- The strategies and habits that I developed to save $100k

- Things I could have done better on my journey to $100k

If you’re just looking for a quick answer, the TL;DR version is that I was privileged enough to graduate without student debt and with some money saved from my university job, then I job-hopped to increase my pay, had some side hustles, saved 30% of my income, and contributed to my investments and retirement accounts.

For a more detailed version, read on.

What’s the big deal about $100k anyway?

Charlie Munger famously said, “The first 100k is a b*tch but you gotta do it. I don’t care what you have to do—if it means walking everywhere and not eating anything that wasn’t purchased with a coupon, find a way to get your hands on $100,000. After that, you can ease off the gas a little bit.”

Saving up the first $100k will be tough and requires some sacrifices. Unless you came from a wealthy family or had a sudden windfall, getting to $100k will largely depend on how much money you can save. Investment returns, at this stage, play a very small role in growing your money.

But Charlie also makes the point that things get easier once you pass $100k.

Why?

That’s when investment returns and the power of compounding will help propel your net worth.

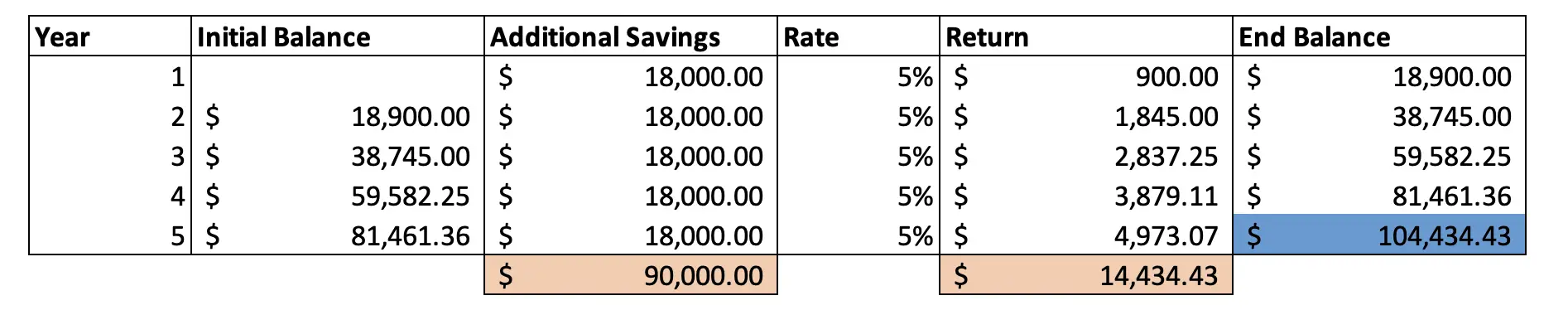

To give you an idea of what I mean, let’s say you want to have $100k in 5 years. Using 5% as the rate of return (slightly below the 10-year average return on EPF, or if you’re in Singapore, slightly above the average CPF return), you’ll need to save about $18,000 a year, or $1,500 a month to get to $100,000.

You can see that most of your net worth on the road to $100k will have to come from your savings ($90,000) and that the amount you earn in interest is only about $14,000.

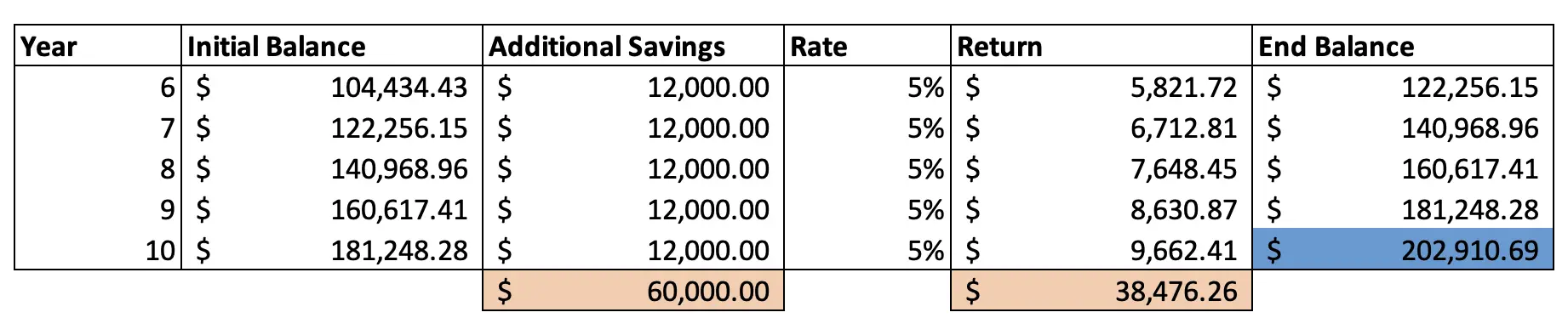

Now let’s see what happens after you’ve passed the $100k mark. Assuming you want to get to your next $100k in 5 years too, you’ll only need to save $12,000 a year, or $1,000 a month.

Instead of saving $90,000 in total, you only need to save $60,000 (or two-thirds of your initial yearly savings) to get to $200,000. This is what Charlie meant by being able to “ease off the gas” once you’ve passed $100k – you don’t have to save as much money because compounding is starting to fuel (pun very intended) the growth of your net worth.

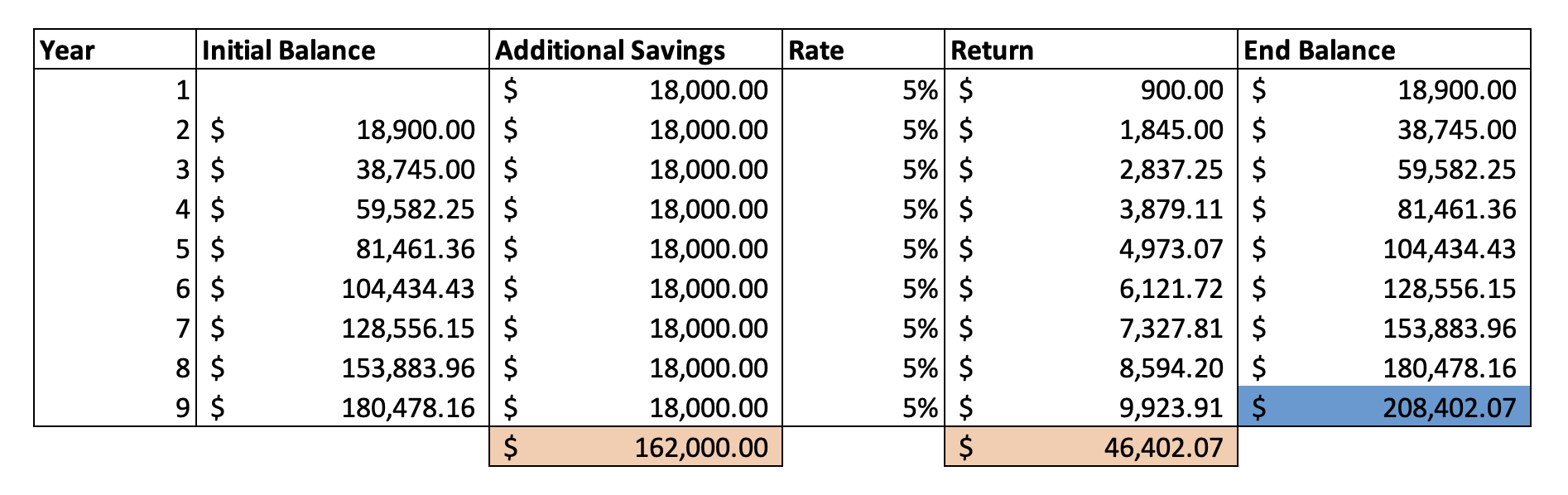

Or if you want to look at it another way, it takes you less time to get to $200k than it does to $100k if you’re saving the same amount each year.

As the table above shows, after 5 years of saving to get to $100k, you’ll need to save up for another 4 years to get to $200k if you stuck to the same savings amount each year.

This is the brilliance of compounding and why $100k is seen as a goal for many people who want financial freedom.

But getting to $100k isn’t all just about effort

Now while Charlie Munger says that cutting coupons and walking everywhere is going to be enough to help you save $100k, the reality isn’t as clear-cut.

Charlie was, after all, an upper-middle-class, college-educated, white, cis-gender man living in one of the richest developed nations in the world before he became a billionaire.

But if you grew up in a broken household with no family support, or didn’t get the chance to go to college, or are simply earning minimum wage (or less than) and living paycheque to paycheque, your hurdles are that much larger than Charlie’s were.

So, we have to acknowledge the role that privilege and luck play in giving some of us an advantage over others financially.

In my case, I was privileged enough to grow in an economically stable country. I went to university on a full scholarship, which meant that I didn’t have to take on any student loans.

I chose the “right degree” (finance), which made me more employable and taught me fundamental finance principles such as compounding at a much earlier age than most people. I started my career at the “right” job (in an investment bank), which opened more doors for me to progress in my career.

While my parents didn’t give me an allowance in university, I was lucky enough that my university job – tutoring wealthy teenagers – sustained my student lifestyle and allowed me to save RM9,000 ($3,000 in SGD) before I even started working full-time.

In a nutshell, my circumstances, which were outside my control, made reaching $100k by 30 an achievable goal.

Why am I telling you all this?

Because I don’t want you to get down on yourself if you’re struggling to save $100k. Your hurdles may be larger than mine.

Just remember that $100k is just a number and it isn’t as important as the effort you put in to save whatever you can within your ability. Set your own pace and savings goals, and don’t use $100k by 30 as a benchmark just because all the personal finance articles (including this one) talk about it so much.

Strategies and habits that helped me get to $100k

Saving consistently (as much as I can)

Privilege and luck will get you far enough, but they will be wasted if you don’t reign in your spending or have the discipline to save and invest.

Believe me, even a trust-fund kid, or a $50k-per-post influencer, or a multi-million-dollar business owner can go broke in a matter of a couple of years because they don’t see the need to save money. Heck, even Rihanna almost went bankrupt at one point.

So, that’s the most important driver that helped me get to $100k – a habit of saving consistently since I was 22. Each month I aimed to save at least 30% of my income. I didn’t always save that much but I always made sure I was spending less than my earnings each month.

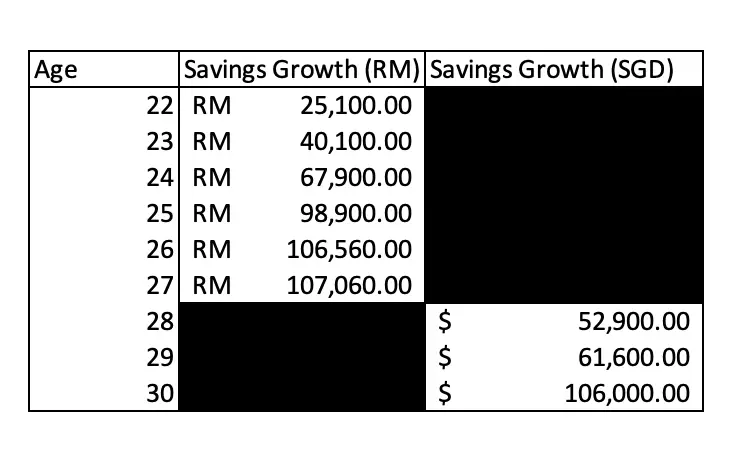

As I love creating tables in Excel, you can check out how much my savings grew each year since I started working below.

There are a few things that I want to share to provide some context to the table above.

- Right out of the gate, I had RM9,000 saved up from my university job, which helped fund my necessary expenses when I started working.

- I include my EPF and CPF contributions as part of my savings calculation. That’s because I consider these funds as “forced savings” from my monthly income. Plus, these retirement funds also generate returns that will compound over time.

- I hit RM100k by 26 years old, but my savings stagnated right after that when I started a period of self-employment. During that year, I didn’t have a stable income, and I was also dealing with anxiety and depression, which significantly affected my expenses (and judgement) that year. This goes to show that things will happen in life that will impede your financial plans.

- When I moved to Singapore, I aimed for $100k in savings. This meant that the savings I had in Malaysia shrunk by a factor of 3 (to about $30,000) due to the exchange rate. But with a lot more discipline, I managed to hit $100k about 3 years after moving to Singapore.

Seizing opportunities to earn more money

I cannot emphasise enough how important it is to increase how much money you’re bringing into your bank account every month. Increasing my income – through new job opportunities, pay raises, and side hustles – played a significant role in helping me reach $100k by 30.

1) Side hustles

For example, though my starting salary was RM2,800 back in 2013, I was comfortably taking home another RM1,500 to RM3,000 from the various side hustles I had.

Since my side hustle income fluctuated from month to month, I always operated on the notion that I can only spend within the amount I was earning from my day job. So, effectively everything I earned from my side hustles went into my savings.

2) Seeking new job opportunities

In addition to having side hustles, I also hunted for opportunities to increase my earning power through my day job. One such opportunity was the chance to work in and live in Singapore.

My first role in Singapore was as an account manager at Facebook. Through this role, I learned valuable digital marketing skills and became a Facebook Ads expert. Little did I know that that opportunity opened yet more doors to progress in my career and savings goals.

3) Negotiating salary

After that job, whenever an opportunity to move to a new role or company came up, I asked for a salary of at least 20% higher than my previous one.

But in all honesty, salary negotiations terrify me.

Every time I do it, my imposter syndrome kicks into full gear and all kinds of negative thoughts will run through my mind – “I shouldn’t ask for so much money”, “What if they think I don’t deserve it”, “They’ll think I’m a fraud”.

But I just grit my teeth, psych myself up and go in with the mindset that it’s my right to ask and I should exercise that right (and you should too), regardless of the outcome. So far, I was lucky enough to get what I asked for every time I job-hopped.

Investing my savings

Aside from increasing my income, there’s also the matter of putting my savings into investments that can compound over time.

Growing wealth is boring and slow and happens over a long period of time because the impact of compounding can only be felt when your initial capital grows larger (as I shared earlier in this article).

So my strategy is to just be patient. I buy and hold individual stocks and broad market ETFs that give me moderate returns each year. I also invest in Endowus’ managed portfolios for my bond and international market exposures.

These returns on my investments did somewhat help get me over the $100k mark before I hit 30, albeit the percentage was small.

Minimising debt

The only debt I had throughout my 20s was a car loan. A car is a necessity in Malaysia, but I didn’t care what kind of car I drove, I just needed one to get me from point A to point B. I had a Myvi, which had an affordable monthly instalment of RM500.

As I also always paid my credit card in full every month, I wasn’t slapped with high-interest charges that could derail my journey to $100k.

What I could have done better

Truth be told, I could have saved a lot more money in my 20s. Looking back on it, while I was disciplined in my savings, I also made room in my budget for the stuff that I enjoyed doing or stuff that I wanted to invest in at the time such as:

- Travelling

- Moving out of my parents’ house and renting a place on my own

- Investing in taking my CFA exams

- Business expenses

- Helping pay for my sister’s education

- Personal pleasures such as going for massages, facials, and pedicures

- Paying medical bills

None of the items on the list above came cheap. I could have definitely gone without them, but all of the things listed had a positive intangible ROI that enriched my life and my relationships. The trick was to ensure that I was spending within my means as much as I could.

At the end of the day, what really made the most difference was that I increased my earning power so that I can afford these financial obligations or “life investments”, as I would call them.

If there’s one thing you can take away from this is that you don’t need to completely sacrifice every single joy, relationship, or life goal and live on the bare minimum to get to $100k by 30.

Saving $100k is hard but not impossible (if it’s something you want to pursue)

I will not sugarcoat it – the road to $100k wasn’t easy. I had to actively strategise what I wanted to do in my career, and how I spent my time. If you’re thinking of growing your net worth too, you may want to ask yourself, “Am I on a career path that will make me more marketable and help me boost my earning power?”.

Be warned though, a career that gives you the ability to earn and save more money may not be a career that fulfils you and you may end up having to trade in your passion for money. So, you need to ensure that that trade-off is something you’re willing to make.

Earning more money is half the equation. The other half is ensuring that you’re saving consistently, even if it meant that you couldn’t enjoy some of the more lavish experiences in life.

There were many times when I had to say no to vacations, cafe meet-ups, and drinking sessions because it was out of my budget. I even gave up my penchant for massages, facials and pedicures because I realised what a huge money drain those treatments were.

Saving $100k is a nice goal to work towards but ultimately, it boils down to whether that’s a goal YOU want to pursue in your own life and what you’re willing to do to get there.

What financial goals are you pursuing? Let’s talk about them in the comments, or Facebook, Instagram, or Twitter.

Well written and explained. Thank you for sharing your journey. 🙏