I’m On A Career Break (Again)

Yep, I’ve done it again. I’m back to being funemployed, living up to the namesake of this blog once more.

If you’ve been here before, you might know that I quit my banking job in 2017 to take a year-long career break. The intent of that career break was to explore new career paths, travel, and develop new skills.

I vividly remember the overwhelming mix of terror and anxiety about my decision back then.

Thoughts raced through my mind, ranging from, “This is insane, I’m making a huge mistake” to “I’m going to run out of money and end up homeless?”.

Despite having enough savings to sustain me throughout the break, I didn’t know what to expect, nor did I plan what to do on my break properly.

Thankfully, I didn’t end up homeless.

Quite the opposite happened – I ended up moving to Singapore. Looking back on it, it was a serendipitous turn of events that wouldn’t have happened if I didn’t take that career break.

This time around, I feel much less terrified and anxious about my decision, having already done it before, and landed on my feet. Not to mention, I went into this break with a more concrete plan.

If you’re also considering a career break (or just curious about the idea) but are terrified to take the leap, much like I was in 2017, let me share my insights. Below, I’ll delve into my experience planning for a career break and offer practical tips to ensure you have a fruitful and meaningful career break.

Hopefully, it’ll help you gain the confidence you need to take your own break.

Why take a career break

Whether you refer to it as being funemployed, taking an adult gap year, or having a mini-retirement, the reasons behind career breaks are as diverse as the people taking the leap.

For some, a career break gives them the opportunity to travel the world and immerse themselves in new cultures to gain a broader perspective on life. Others may choose to take a break to pursue a course, honing their skills or acquiring new ones.

There are those who take time off work to focus on family, either spending time raising kids, or taking care of aging parents.

In my case, I took this break to reassess my career goals.

After working for more than four years in Singapore, I reached a point where I felt my career wasn’t going in the direction that I wanted it to.

I was a sales manager at a very small startup, where I had my hand in just about everything – sales, operations, marketing, managing multi-country teams, content production, and even being a spokesperson. Talk about wearing multiple hats!

I enjoyed my time in that role. It was such a valuable learning experience, and I gained a ton of skills, exposure, and professional growth.

But here’s the downside of having such a broad range of responsibilities: it left me feeling spread too thin and after more than two years of this, it was clear that I was burnt out. I also wanted to focus on honing my skills as a sales manager, but with so much on my plate, I just couldn’t give it the attention it deserved.

Plus, I was questioning whether I still wanted to be in this industry (digital media) for the next 10 to 15 years of my life.

Sure, I could have hopped right into another job, but I recognized that I was already experiencing burnout, which incidentally, started to affect my health. I didn’t want to rush into another role just for the sake of it, knowing my burnout could cloud my judgment over my next career move. I needed time to recharge, reflect, and get my priorities straight.

Taking a step back from the corporate world seemed like the wisest move.

Should you take a career break if you’re burnt out?

If you’re feeling the weight of burnout just like I was, and you’re two seconds away from throwing in your resignation letter and making a dramatic exit, I’m here to tell you to hold your horses, sis.

Now, I’m not saying you shouldn’t take a career break if burnout has got you down. But, before you take the plunge, you may want to consider a few things.

If you’ve reached the point where you’re absolutely certain that returning to the same company or industry isn’t in the cards for you, then a career break could be an opportunity to explore new paths.

But hey, maybe you genuinely enjoy your work and can see yourself continuing to grow in your current company, but simply need some time off to recharge and rejuvenate. Then you can consider requesting a sabbatical instead. Many companies these days recognize the importance of work-life balance and offer sabbatical programs to retain employees.

So, whether you’re seeking a complete career change or just need a breather, there are options available to suit your needs.

But if your company doesn’t offer you a sabbatical (their loss, really) and you’re 100% certain a break is what you need, then by all means, throw that letter.

How long can your career break be?

My plan is to take six months off work. But it’s important to note that how long of a break you take is entirely up to you and your unique circumstances.

I’ve met people who’ve taken breaks ranging from one to two years. Some people find that a shorter break is enough time to recharge and reset, while others may crave a longer period for self-discovery, and pursuing new interests.

The key is to assess your own needs, goals, and financial situation when deciding how long to take a break.

How I’ve saved up for a career break

Saving up for a career break is all about careful planning and being mindful of your finances. Here are some things I did to help me save up for my career break.

Track my expenses

First things first, I’ve been diligently tracking my expenses for years. Because of this habit, I have more than enough data to gauge how much I needed to save for my break.

You’ll feel so lost and anxious if you don’t have a realistic grasp on your finances before quitting your job. So if you haven’t started tracking your expenses, start now.

Project how much I’ll need

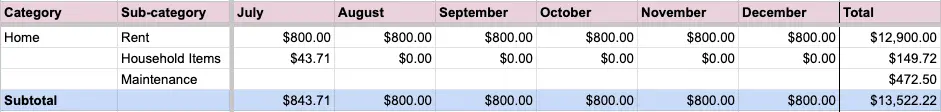

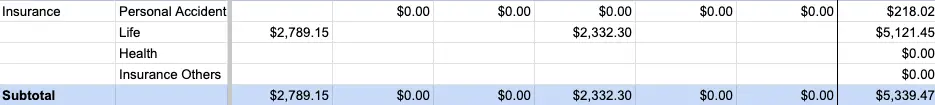

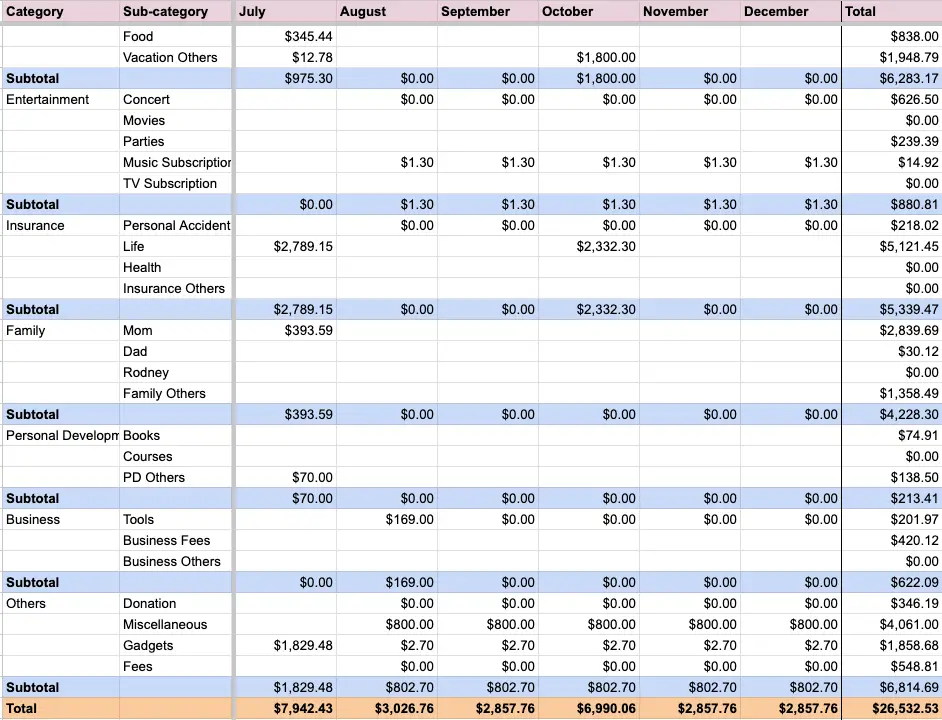

Next, I projected my expenses for the entire duration of my intended break. On my expense tracking sheet, I forecasted all my monthly commitments including rent, car loan repayments, taxes, and so on.

Then, I account for one-off payments that will be happening in those 6 months such as my lump sum insurance payments and business expenses.

I also factored in travel expenses and additional funds to spend on hobbies. Having a separate travel fund was essential to ensure I could explore and enjoy new experiences during my time off guilt-free.

After adding up the numbers, I needed about $26,600 to see me through my break.

Go above and beyond my emergency fund

This $26,600 had to be saved up above and beyond my emergency fund, as I wanted to have a dedicated fund specifically for my career break. A career break, after all, isn’t exactly an emergency.

I started saving for the career break in January 2023 and by the time I resigned in June 2023, I managed to save $24,000 (or $4,000 a month), just $2,000 shy of my goal.

Sidenote: When I first started thinking about taking a career break, I planned to quit my job in December 2023. However, my health deteriorated to the point that I couldn’t ignore it anymore (I was falling sick every month), so I decided to move my timeline forward by 6 months and adjust my budget accordingly. If I had stuck to my original plan, I would have more funds to “play with” but as these things go, you can’t always get what you want.

Don’t forget insurance

I made a point to mention my insurance payments earlier. People often overlook their insurance when planning for time off. You need to be prepared for the possibility that your break isn’t going to be as smooth sailing as you might like.

What if you fall sick or get injured?

Remember, when you’re no longer employed, there’s no company to provide you with medical coverage. So, make sure your health, travel and other required insurances are in place to safeguard yourself during your break.

Sticking to my break budget

Saving up for a break is one thing, making sure I stay on budget throughout is going to be the challenge. Sticking to a budget is key here because it will ensure that I complete my career break without dipping into my investments.

Here are some things I’m going to do to help stretch my break fund further.

Downgrade my lifestyle

To maximise my savings during this break, I’m intended to downgrade as much as possible. This means cutting down on eating out at restaurants, transportation costs, shopping, and anything that’s not necessary.

Be realistic

I have all these grand plans for the next 6 months (more on this later). So. Many. Things. I’d like to achieve.

But realistically, time and money will limit what I can do. So, I’m going to have to prioritize activities and experiences that will truly make the most impact in my life, whether that be professionally or personally.

Making some extra money

Just because I’ll be on a career break doesn’t mean that I can’t earn money. I have this idea of being a barista or working at a fitness centre just to experience what it’s like.

In fact, I already have a part-time job lined up that I’ll be starting soon! After all, I still need to make up for another $2k shortfall in my career break fund.

I’m also intending to take up some freelance work to supplement my break fund, which will give me a little more financial flexibility.

What I’m planning to do on my career break

I’m acutely aware that most people don’t ever get an opportunity to take a career break, so I’m determined not to let this precious time go to waste by mindlessly binging on Netflix all day.

The main priority is to spend time planning out my next career move. This could come in the form of researching new roles and companies, exploring new projects, meeting with (new) people and picking their brains, and developing skills in new areas. Then, of course, applying for jobs in the field that I choose.

Speaking of developing skills, one thing I’ve always wanted to learn but never got the chance to do is programming. I’ve always held a keen interest in data science and with the widespread use of AI technology recently, I wanted to explore how AI can work with data during my time off.

I’m also going to take time to indulge in hobbies. What those hobbies are, I do not know. You see, I’ve always been so focused on academics in school and my career as an adult, I never made time for leisure and creative activities. If you asked me today, “Nicole, what are your hobbies?”, I’d tell you I don’t have any. But I want to change that. I’ve put together a list of hobbies to try out: cooking, playing the piano, pottery, and even growing my own tiny edible garden.

Of course, focusing on my health and fitness is also high on the agenda. I want to spend more time on self-care, nutrition, training and practising yoga to strengthen and nurture my body.

Other things I’ve listed down, and am thinking of doing include:

- Travelling (I’m going to do a trip to Germany to visit my sister in October)

- Volunteer work

- Take up a coaching course (?)

- Writing more (on this blog, or maybe some other platform if it doesn’t relate to personal finance)

I’m realistic enough to know that I may not be able to do everything on this ambitious list in the span of 6 months. But it’s great to have it handy as a guide to plan and keep me engaged during my break.

Ultimately, that’s the beauty of a break – having the freedom to choose what I want to do with my day. I can always adapt and change what I do, allowing me to embrace new experiences and shape my break to make it meaningful and fulfilling.

Are you considering a career break? How will you plan for it? What will you do on your break? For those who have taken a career break, any advice? Leave your answers in the comments or chat with me about it on Facebook, Instagram, or Twitter.

Congratulations! The last time I took a break, it lasted a good 2 monthS before I panicked and started hunting for full time work lol. When I look back, I realise I didn’t plan my grand adventure in Australia well – I didn’t bring enough money and had no way to support myself when I was there. Definitely important to plan financially for a career break.

Thanks for sharing! I’m sure that two months was what you needed. And totally get the panic! I still catch myself periodically going onto job boards and applying for jobs lol. I didn’t plan my previous break back in 2018 either, but I was lucky that I managed to pull through it that time. This time around, a bit more prepared but still feel the nerves that come with the uncertainty. I guess that’s quite normal haha.