Asset Allocation for Malaysians: What is The Best Portfolio Mix for You?

Over the last few months, I wrestled with the concept of asset allocation. In theory, this is a straightforward concept but in practice, I don’t take asset allocation into consideration when making investment decisions.

What Is Asset Allocation?

At some point in your investment journey, you might find yourself thinking, “There are just too many investment options out there, how do I choose the right one?”

The answer is there shouldn’t be just ONE investment option that you should be putting your money into. Ideally, your investments should consist of a variety or a mix of assets that fit you.

This mix is different for each individual.

Think of a gift basket. When you buy a gift basket for someone, you want to have a variety of options in the basket. One person might be delighted to receive a gift basket filled with chocolate. But for another, a fruit basket will be better received. And yet another person will like a basket that has 50% fruits and 50% chocolates in it.

How you structure a basket of investments is called asset allocation.

Why is Asset Allocation Important?

Whenever I get asked about investing, almost 90% of the time people want to know how to pick stocks or when to time the market.

This is a narrow view of investing. It isn’t necessarily wrong to approach investing this way. Heck, people have found success growing their wealth with this approach. (see Dividend Magic, Serious Investing, Pelham Blue Fund).

However, most don’t have the acumen for picking the right stocks. A majority of people don’t even want to invest in the stock market directly. But everyone wants to grow their net worth. So how?

Stock picking and timing the market is half the battle. Making sure you’ve allocated your funds to the right assets is crucial to your portfolio performing well.

I’ll use my own stock portfolio as an example.

In my Mid-Year Review, my heaviest allocation is in INARI, currently standing at 26.62% of my total initial investment. Because INARI is now at a paper loss of 15.08%, it affects the overall value of my stock portfolio.

| Stock | Last Done Price | Average Price | % Holding | Unrealised Profit/Loss |

|---|---|---|---|---|

| INARI | 1.61 | 1.896 | 26.62 | -15.08 |

| LIIHEN | 2.89 | 3.00 | 16.85 | -3.67 |

| MAYBANK | 8.98 | 9.55 | 24.15 | -6.1 |

| PARAMON | 2.28 | 1.84 | 10.31 | 24.18 |

| UCHITEC | 2.88 | 2.62 | 22.07 | 9.92 |

| Overall % P/L | -1.40 |

Despite stocks such as UCHITEC and PARAMON performing well, the impact of the gains is lesser than the losses because the weights to these stocks are lower.

As you look at the entire portfolio and still find yourself not achieving the return that you’re aiming for despite having some winning investments, then you’ve not chosen the right mix.

In finance, there’s a term for this, the portfolio allocation is considered sub-optimal.

Asset Allocation is Much More than Your Stock Portfolio

But again, I’m still missing the big picture here. Asset allocation encompasses much more than just your stock portfolio; it should include ALL the assets that you have in your arsenal right now. This includes bonds, real estate, gold, ETFs, unit trusts and also cash.

Outside of the mandatory contribution to EPF, I’d wager a guess that most of us in Malaysia have sub-optimal asset allocations. Why? Because most of us are holding our net worth in cash.

The Saving Mentality

Growing up, there were public service ads on TV that went something like this:

A little girl, with much excitement, goes to the bank with her tabung filled with coins. The bank teller takes these coins, pours them into a box behind the counter and then gives the mother a savings book. Both the mother and daughter smile cheerfully as they look upon the savings book and a narrator echoes a corny tagline like, “Start saving for a brighter future.”

Malaysians have a saving mentality. We’ve been taught that saving money is important. Saving money for emergencies, for retirement, saving so that Future You will have it better than Present You.

And it’s good that we are cultivating this mentality. It is widely reported that Malaysians aren’t saving enough. Millennials are struggling to come out of debt much less have savings set aside for the future.

But what happens when you’ve come to the stage where you saved enough? Or more importantly, at what point is “enough” before you start looking to put that money to good use? 3k? 10k? 50k?

And this is the crux of the problem. We don’t really know how to gauge what is “enough savings” because enough is vague. And so, out of habit, we accumulate cash in our savings accounts and fixed deposits because we assume that there isn’t enough to start investing.

If my own habits are any indication, generally people concentrate more than 50% of their net worth (excluding EPF) in low interest, low-risk assets such as fixed deposits or cash.

How to Improve Your Asset Allocation

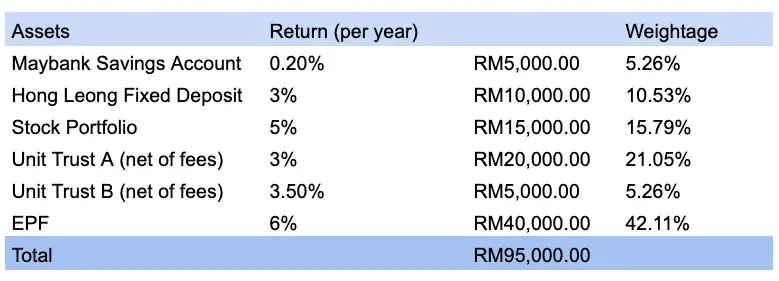

Note down all of the assets you own and its dollar value. Then, figure out what percentage of your total assets each category on your list holds.

Weightage = Asset Amount/Total Assets

A quick example:

As you can see, EPF accounts for almost half of the total assets. This is followed by Unit Trust A (21.05% of the total).

Here’s the sitch, Unit Trust A gives a lower return (3%) after deducting fees than say, the stock portfolio (5%). Ideally, you’d want to reallocate the funds from Unit Trust A into the stock portfolio.

Like I mentioned earlier, in most cases, the breakdown could look more like this:

If your funds are heavy on fixed deposits and savings account (40% to 50% of all your assets), you may want to start thinking about putting more of that money to work for you.

Things To Take Into Consideration

Now, the above examples are an oversimplification. There’s a whole list of things you need to consider when you decide where to allocate your money.

What is your risk tolerance?

Asking this question helps determine why you decide to allocate your assets in a certain way. You might think, “Ah, so stupid! Why put money in low performing Unit Trust A? Put lah in the stock market!”. But a conservative investor might put more money in Unit Trust A because it is less risky than the stock portfolio. Start gauging your comfort level by asking yourself how much are you willing to put at stake for a higher return.

What is your age?

If you’re in your 20s, you have more opportunities to take risks as opposed to someone in their mid-40s. Your investments will have time to recover from market downturns by the time you reach retirement age.

How much cash do you need anyway?

Coming back to the question of “enough savings”. How do we put a number on it to help us decide when to start investing? Personally, I aim to set aside a savings of 5 months’ salary and then shoving the rest into various investments. If I were to be out of a job, I still have up to 5 months to look for a new one before having to liquidate my other investments.

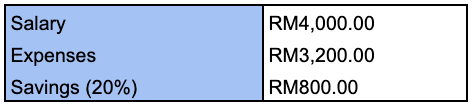

For some people, getting to their target level of savings is difficult. Saving 5 months worth of salary may take a long time. The other option is to break it down in your monthly budget.

Target an amount you wish to save every month. For instance, 20% of your take-home pay is quite doable.

Split this 20% into two parts – for investing and for savings/emergency fund. You can split the RM800 by half (RM400 into investing & RM400 into savings) or by a number that you feel more comfortable with.

How are your investments related to each other?

Unless you are super financially-savvy, this one is difficult to figure out. At the very least, think about how each asset might be affected by current market conditions.

If Unit Trust A comprises of mostly Malaysian growth stocks and your stock portfolio also has Malaysian growth stocks, chances are both Unit Trust A and your stock portfolio will react similarly when there’s a bad outlook for that sector.

You should aim to diversify your investments to minimize the chances of losing your overall asset value due to bad market conditions. It is known that bonds and stocks have an opposing relationship (when stocks do well, bonds generally don’t). Gold, for instance, starts increasing in value during market uncertainties. Real estate value is pretty inelastic and doesn’t drop much unless there’s a huge financial crisis.

How are YOU related to your investments?

A couple of weeks ago, I posted How to Calculate Your Economic Net Worth. In it, I discuss that our net worth should account for our assets, liabilities and our ability to create income by being employed and receiving a salary.

You are an asset and as a result, your profession and the industry you work in can also be affected by market conditions. If you’re an investment banker, there’s a chance you could be retrenched when the economy isn’t looking so good. Hence, you may want to put your investments into more conservative vehicles such as bonds. If you’re a university professor that has tenure, lucky you, your job is stable and you can afford to take on riskier investment.

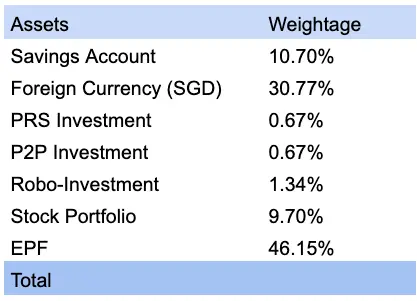

Analyzing Nicole’s Asset Allocation

Once you have a clearer picture as to how you’d like to structure your asset mix, the next part is figuring out where to park your money.

While that decision is entirely personal, I’ll share with you my own asset breakdown, my thoughts on the current structure and what I’d like to change about it.

At present, the stock portfolio only accounts for ~10% of my overall assets, which yielded a dividend return of 7.55% last year.

I used to advocate for allocating a big chunk into the stock market but these days, actively managing my own stock portfolio becomes increasingly difficult.

However, knowing that I can take more risk because:

- I’m young(-ish),

- Single

- Have no children

- Have transferable skills

- Have minimal debt obligation

- Save money consistently

opens up a whole new world of investment options for me.

I’ve steered well clear away from investing in unit trusts because I lose a lot of potential income to fees. I’m also not a fan of gold investing (hard to predict return) or buying real estate (too much commitment).

Only recently I’ve started accumulating savings again after depleting it during my gap year. As most of it is in Singapore dollars, they fall into the forex category (which is ~30%).

I love the whole robo-advisory thing. With both Stashaway and Funding Societies (referral links guys!), I’m keen to shift more funds into these vehicles. It takes less effort on my part to monitor and I will also get exposure to a more diverse pool of investments. Primarily with Stashaway, I get exposure to the US market (at a much lower fee than unit trusts).

What I hope to do is move more of my Singapore dollars into P2P and Robo-investments in the near future.

Final Thoughts

As a whole, it can be incredibly daunting to start assessing your asset mix, especially when you’re a novice investor.

My advice is to start small and take baby steps.

You don’t just immediately get to the best mix, it’s a gradual process of deciding and shifting money. As time passes, the mix will change as you earn more money and go through the different stages of life.

Realistically, I don’t expect anybody to have an “optimal asset mix” in the traditional finance sense. Life moves way too fast and sometimes we make decisions that aren’t financially rational. And that’s okay. What we should always try to do (and I advocate this constantly) is keep educating ourselves, keep assessing, reflect and then make our decisions accordingly.

Stay sharp, keep learning. Till next time.

What’s your asset mix right now? Comment below or find me on Facebook, Instagram, and Twitter.