2023 Annual Money Review

As a child, I couldn’t understand when adults said “The years just fly by”. Now I get it. 2023 felt like it just whizzed past in a blink.

It was a year of change. I took a career break at what some deemed the worst possible time – layoffs were rampant and the job market in Singapore didn’t look good.

But six months later, I’m happy to report I’m not living in survival mode.

Thanks to a combination of a solid savings foundation and finding alternative sources of income, I stayed afloat (and saved money!) despite not working a corporate job for 6 months.

Now, let’s talk numbers.

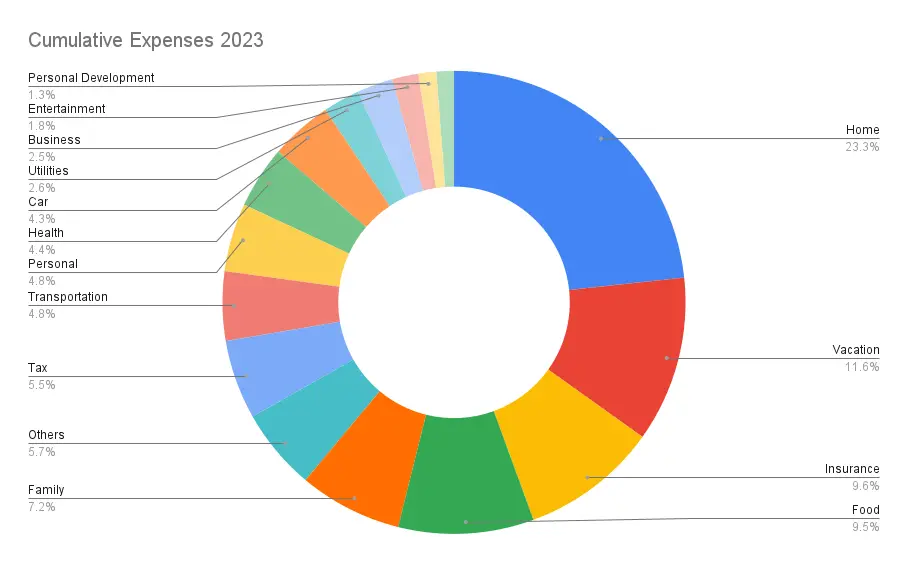

Total Expenses in 2023

In 2023, I spent a total of $58,716.88 – that’s roughly $4,893.07 a month.

These were the top 4 expense categories:

Housing (23.3%)

No surprises here. Rent is the biggest expense for foreigners working in Singapore, and I am no exception. Our landlord increased our rent by 30% in December 2023 when we renewed our lease so a bigger chunk of my income is going to rent in 2024, sadly.

Vacations (11.6%)

One of my career break goals was to travel so I budgeted $8k for vacations in 2023. I came under budget at about $7k.

Insurance (9.6%)

Personal finance rule of thumb is to set aside not more than 10% of your income for insurance protection. I spend around that amount but it still pains me to fork out the sum.

Food (9.5%)

Though I spent less on food in 2023 than in 2022, food expenses still come in high on the expense list.

2023 Wins

Saving extra money to quit my job

I already decided to quit my job going into 2023. But I wanted to make sure I had enough saved up to tide me through a career break, above and beyond my emergency fund. So I committed to a savings plan where I put aside 50% of my income each month.

When I quit my job in June, these savings helped fund the second half of my 2023.

Saving 15% of my income overall

Despite not working a full-time job for the second half of 2023, I still managed to save a solid 15% of my income last year.

Through my network, I picked up some high-value freelance gigs, which have helped cover my living expenses during my career break.

Travelled 6 times in a year

As mentioned, I had already budgeted $8,000 for vacations in 2023.

During the year, I went to destinations in Thailand, Vietnam, Malaysia, and Europe, and still managed to come under budget.

I feel incredibly lucky to be able to take a break and travel for long periods to these places.

2023 Fails

Food wastage

I averaged about $140 a month on groceries. While this is a reasonable expense, I could have reduced the cost further by optimising my grocery purchases. I threw out expired food more often than I would like.

Got scammed

I fell victim to a Carousell reseller scam and lost about $300 in the process. A bitter pill to swallow, but consider me a more discerning and careful buyer now.

Medical costs higher than I thought

I had a few bouts of flu this year and a couple of visits to the specialists that came with a hefty price tag. Even routine checkups hit the wallet hard in Singapore.

Considering these tend to crop up every year, I’ll be exploring alternatives, maybe even heading back to Malaysia for routine checkups.

Had to replace a stolen phone

While travelling in Vietnam, I dropped my phone by accident, only to have it stolen within minutes.

I paid the price for my carelessness with a hefty $1,400 from my emergency fund to replace it.

Life lesson learned the hard way – always keep an eye on your belongings, especially amid exciting travel adventures.

Best buys of 2023

Therapy

I invested in my mental well-being by returning to therapy. I needed some guidance, systems, and strategies to work through some workplace-related issues and therapy helped with that.

Sometimes, the best investment is the one you make in yourself.

Pottery lessons

I’ve always wanted to try a hands-on creative hobby. Pottery was one of them. Engaging in a different kind of creativity, one that involved getting my hands dirty, proved to be therapeutic.

Who knew moulding clay could be so calming and creatively invigorating?

Custom-made clothes

As someone with a short torso and long legs, I perpetually struggled to find trousers that fit just right and blazers that didn’t drown my frame.

When I travelled to Vietnam, I took the opportunity to invest in some custom-tailored blazers and trousers at a fraction of what it would cost in Singapore.

Looking ahead to 2024

Cutting my holiday budget

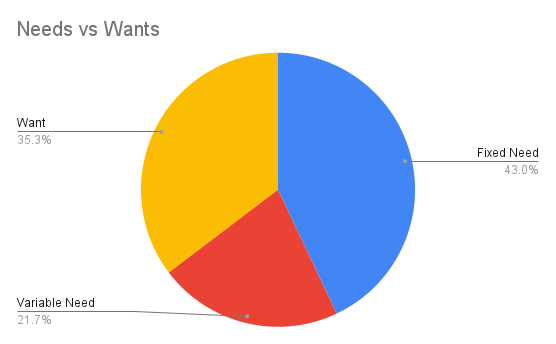

In 2023, a whopping 35% of my spending went into the “wants” category. And since my income might be unstable this year, I want to cut down on my wants.

This includes cutting down on vacation spending.

As a rule, I’ve decided to not travel this year (except for trips back to KL to visit family) until I can consistently earn enough to replace my full-time job’s salary.

Plug money leaks

The devil is in the details, they say. Snacking and groceries – these seemingly small expenses collectively form money leakages. It’s time I optimise, be mindful of the unnecessary, and plug those leaks.

Set up more income streams

I currently earn income by freelancing for various clients. I have also started an agency business to help small businesses launch and grow their social media.

Both these income sources depend highly on consistent work coming in each month. It’s also not scalable – more work depends on getting more clients, which increases time spent looking for more clients and more talent to help deliver the projects.

For now, the freelancer and agency model is sustaining my living expenses but in 2024, I want to explore layering with other sources of income.

The goal is to achieve a monthly income of $10k.

Becoming debt-free

Bye-bye, car loan! 2024 marks the year I bid farewell to that lingering car loan and officially join the debt-free club.

Starting a budget

I’ve always been an expense tracker, not a budgeter.

In the past, I just set aside 30% of my income but I don’t make a point to budget for each expense category.

This results in a lot of reactive money decisions in the past.

I want to change that in 2024 – it’s better to anticipate, strategise, and allocate funds wisely than feel guilty afterwards for overspending. The target of 30% savings remains, but now with a clearer roadmap.

Revamping savings strategy

Freelancing comes with its own set of financial acrobatics.

So I’m tweaking my savings strategy by setting aside a percentage immediately upon income arrival. It’s a proactive approach to navigating unstable income.

Resume investing

As income stabilises, I want to restart investing and grow my portfolio.

Optimising Insurance Plans

Insurance, a necessary expense, but is it optimised? Almost 10% of my expenses in 2023 went towards coverage.

So I’m planning to reevaluate them to ensure that every dollar spent aligns with the protection I truly need.

What I learnt in 2023

I wrote more extensively about my money and life lessons in another article. One thing I didn’t mention is how I find myself in a position of privilege that I didn’t think I’d be in 5 years ago.

To be able to travel at all, let alone jet off 6 times a year? That’s a luxury I didn’t always have.

On top of that, I also upgraded my environment and overall quality of life. Revamping my home office setup makes working feel less like a chore, and living in a condo with access to a swimming pool and gym has made exercising easier.

Without realising it, I’ve designed my environment to help improve my habits. James Clear dubs this as choice architecture, where having obvious cues helps form habits.

These changes were possible thanks to having a bit more money. Looking back five years, I realise the extent of my luck – such choices weren’t within my grasp back then.

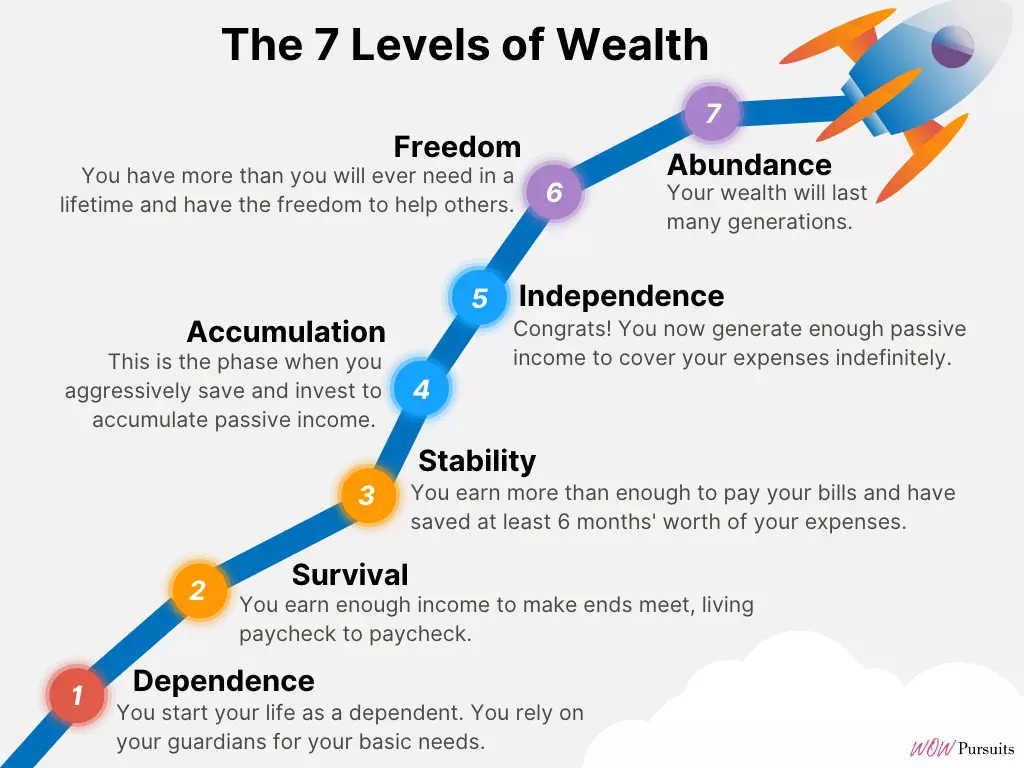

This brings me to the realisation that I’ve hit a new level of wealth in recent years. Using the 7 Levels of Wealth as a guide, I’ve moved from Survival to Stability, where I don’t have to be excessively frugal.

Now I need to focus on the next challenge – how to sustain this lifestyle for the long haul and climb to the next level of wealth. Something to work on for 2024.

What were some of your wins and fails in 2023? Comment your thoughts below or follow me on Facebook, Twitter, or Instagram.