5 Questions To Ask When Investing in Dividend Stocks

Passive income investing or dividend investing is one way to grow your wealth steadily over a long period of time. Dividend investing does not require as much active management and monitoring compared to short-term trading. It’s an approach suited for people who can’t afford to spend time constantly looking at the market.

Most people would say it’s the least glamorous way of participating in the stock market. Nobody’s going to pitch a movie about a middle-aged man who made millions by painstakingly compounding his wealth over 20 years. My tax dollars weren’t used for “The Turtle of Wall Street”. I digress.

Selecting dividend stocks for a long-term investment requires research into a company’s fundamental value. Here are some of the questions to ask when deciding to purchase a dividend stock:

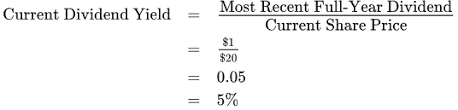

1) What is the company’s dividend yield?

The dividend yield is a ratio of how much dividend is received for every RM we’ve invested in a stock. Here we want to maximize our dollar invested.

Typically, we should look for stocks that yield a dividend of more than 4% per annum. This is the maximum interest rate (if we’re lucky) we’ll receive for placing money into a fixed deposit account. FD accounts are deemed low risk but investing in a stock bears a higher risk.

The value of a stock can fluctuate and we will be investing in companies based on their ability to be profitable. It makes sense to seek a higher return for the higher risk we will take on.

2) Are the historical dividend payments consistent and/or growing?

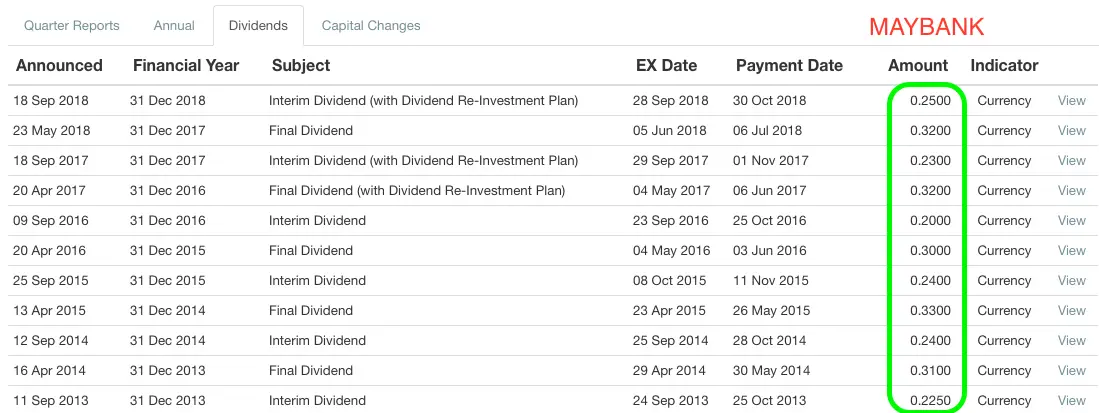

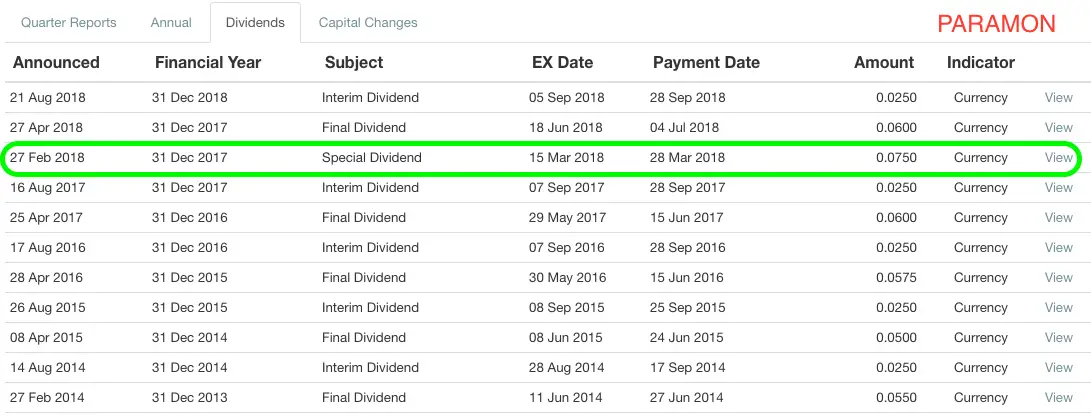

Looking at the dividend yield alone is insufficient in deciding to purchase a stock. We need to consider if the payments are consistent every year.

A consistent dividend payout not only gives predictability to the investor, but it also indicates that the company has stable profits that can accommodate payouts.

Some stocks have one-off payments or special dividends that affect the historical annual dividend yield.

We also need to assess if the dividend payments are growing over time. The dividend yield can be affected by the amount paid out or the market price or both. If the amount paid out has been consistent over the years but the dividend yield keeps decreasing, this means that the stock price has been increasing over time. It’s possible, then, that the stock is overvalued.

3) Can the dividend payout be used to grow the business instead?

This one is a little subjective. Depending on the industry, which stage of the business life cycle the company is in, how much debt the company has, sometimes it is better for a company to not pay dividends at all.

A growing profitable tech company might benefit more from re-investing its profits in order to grow the business, instead of paying dividends to its investors.

On the other hand, mature, well-established companies tend to have very little growth prospects and large cash reserves. It stands to reason that paying out dividends to investors will be the most likely approach for these companies.

A fundamental investor will have to research and judge a company’s financial health beyond its dividend payout to its shareholders.

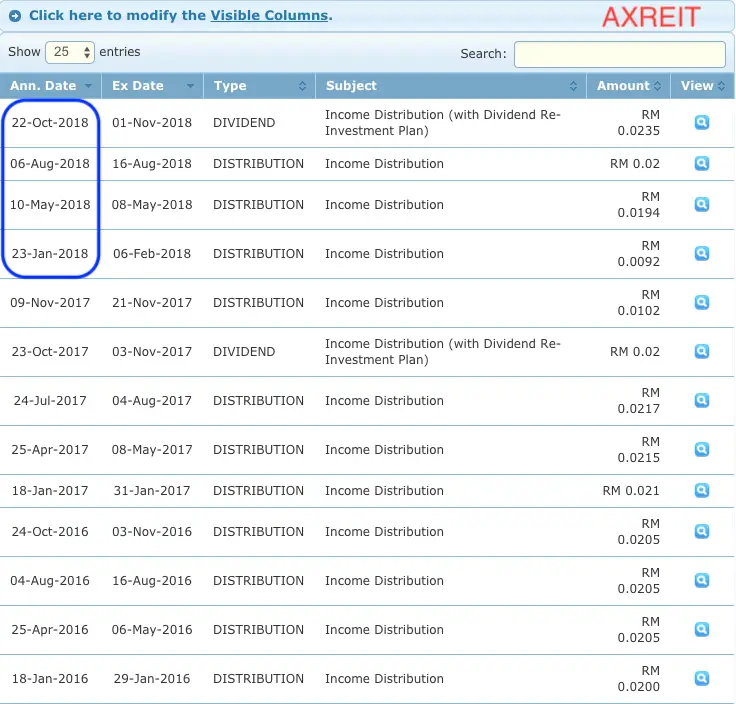

4) How many times a year does the dividend payout occur?

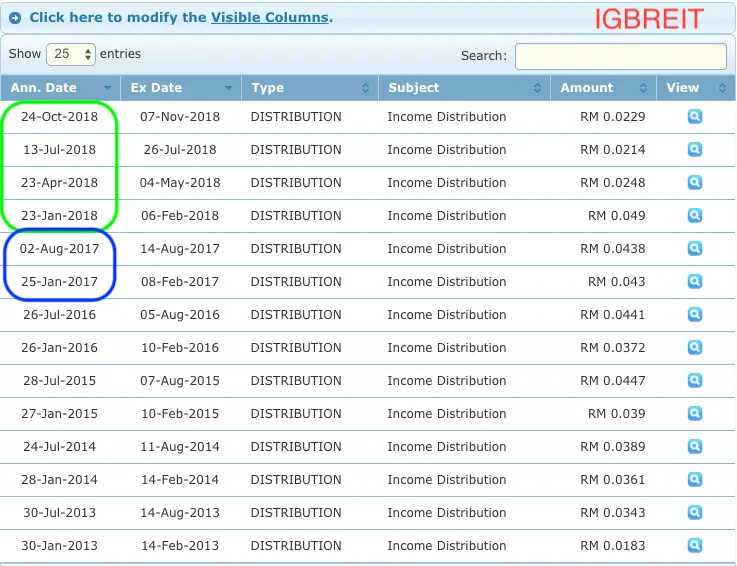

The frequency of payouts during a financial year is especially important for investment in REITs. REIT companies generally distribute almost all of its profits to its shareholders.

Personally, I think REITs should distribute income every quarter. The company isn’t required to reinvest profits so there should be no reason for the management to hold back on paying investors on a quarterly basis.

If a company changes its payout frequency from more frequent to less, it can indicate an issue in cash flow or a change in dividend policy.

An investor should then take a closer look at the quarterly or annual reports to evaluate if the change is sufficiently justified.

5) Should I reinvest my dividend using the Dividend Reinvestment Plan (DRP)?

A company that carries out a DRP gives existing investors the opportunity to reinvest some or all of their cash dividend by buying additional shares. To incentivize shareholders to reinvest, these new shares are at a discount price. Two advantages of investing via a DRP scheme are:

1) overall average buying price can be lowered and

2) the compounding effect means the investor is entitled to a higher total dividend in the future.

Some things to look out for when reinvesting via a DRP

- Are there any additional charges that are incurred for submitting the DRP application? For example, investors need to affix a Malaysia Revenue Stamp (costs about RM10) onto the DRP forms.

- How many new units will be received? Given the reinvestment price and a small cash dividend sum, investors may receive odd lots (less than 100 units). Regardless, long-term investors want to accumulate shares despite the compounding effect being much slower.

What type of dividend policy has the company established?

Related to all of the above questions, companies usually establish a dividend policy so that investors can know upfront what to expect from their investment.

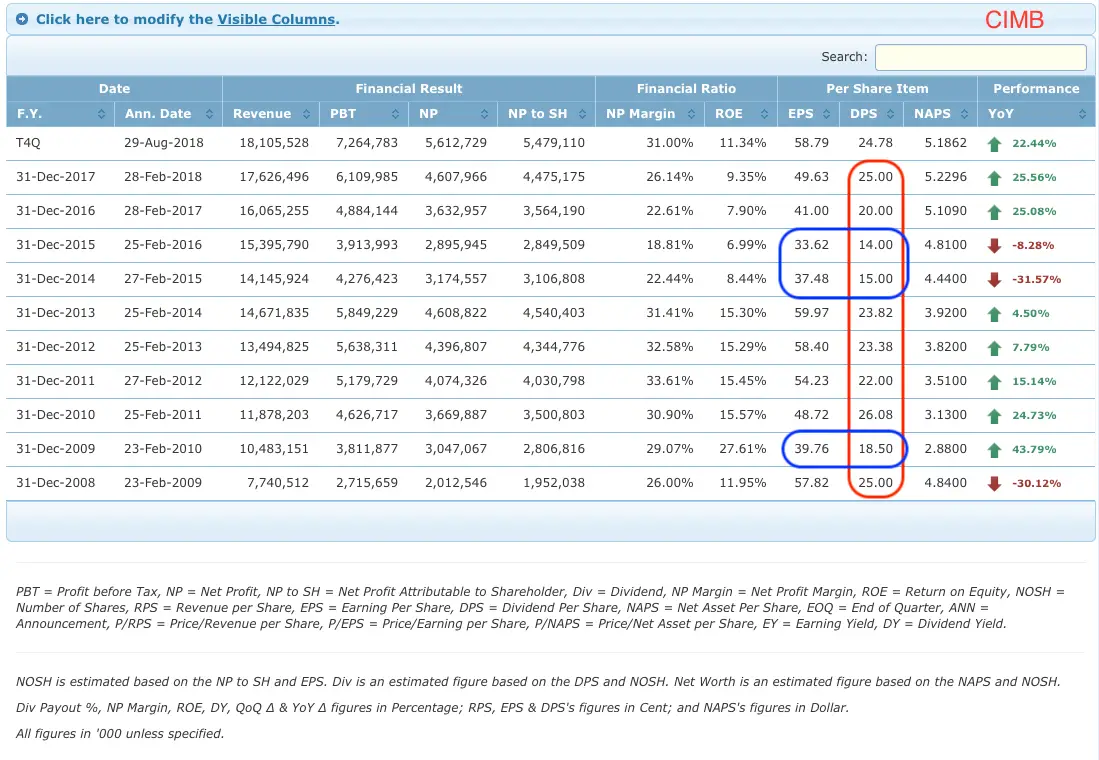

Constant Dividend Ratio Policy

Companies may establish a constant dividend ratio policy where the dividend payout moves in tandem with the profitability of the company.

For instance, a company may set out with a 40% dividend payout ratio. This means that if a company earns a profit of RM100 million this year, RM40 million of the profit is expected to be paid to the investors. If the profit increases to RM150 million during the next year, investors can expect a total payout of RM60 million (40%) that year.

A company will not feel pressured to maintain the same level of payout if profit decreases because the payout is kept at a constant ratio.

The payout ratio is also an indicator of how much the profit the company retains in its reserves for future use. A dividend ratio at a healthy level (normally 40-50%) gives enough of a cushion for the company in case market downturn affect profitability or expansion plans require further capital expenditure.

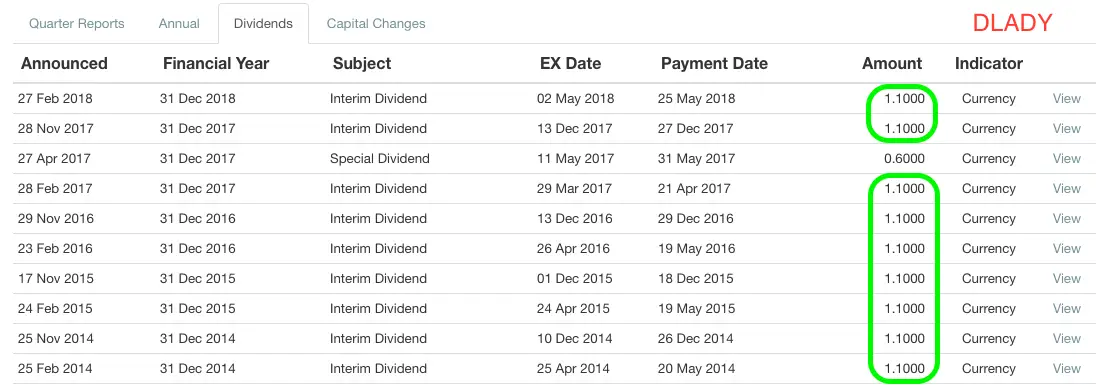

Stable Dividend Policy

Investors can expect a consistently regular dividend payout from a company that implements a stable dividend policy. Matured companies with a large market share have the capacity to maintain the same level of payout because their earnings are fairly stable.

Residual Dividend Policy

Growth companies tend to fall into this category. A residual dividend policy prioritizes retaining profits internally to finance new projects. Whatever that is leftover is then distributed to the investors as dividends. Companies with this policy tend to have inconsistent dividend payments.

While this isn’t appealing to passive-income investors, there are merits to investing in companies that don’t reward its investors now. Investors looking for growth potential will see this move adding value to the stock and its price in the future.

Dividend investing is not a shortcut to financial independence. It is the long road that requires patience and a thick skin to withstand market turmoil. As someone who’s a bit more conservative on my investments, I’ve found it particularly helpful to ask these questions when selecting stocks to add to my portfolio.

Found this article helpful? Share it! You can also find me on Twitter and Facebook.

Image via Unsplash

Great article! I like investing in REITs due to it’s generally high dividend yield and the fact that properties are generally good assets to hold 🙂

Hi Mun Hong,

Indeed, REITS are a good long term investment that gives consistent income yield!