Month in Review: February 2024

Every month, I track my spending and share them openly here. In my Month in Reviews, I go over notable (and often discretionary expenses) for the month and reflect on some key areas of life tied to money, either directly or indirectly: career, health, relationships and personal growth.

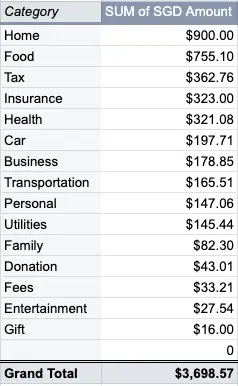

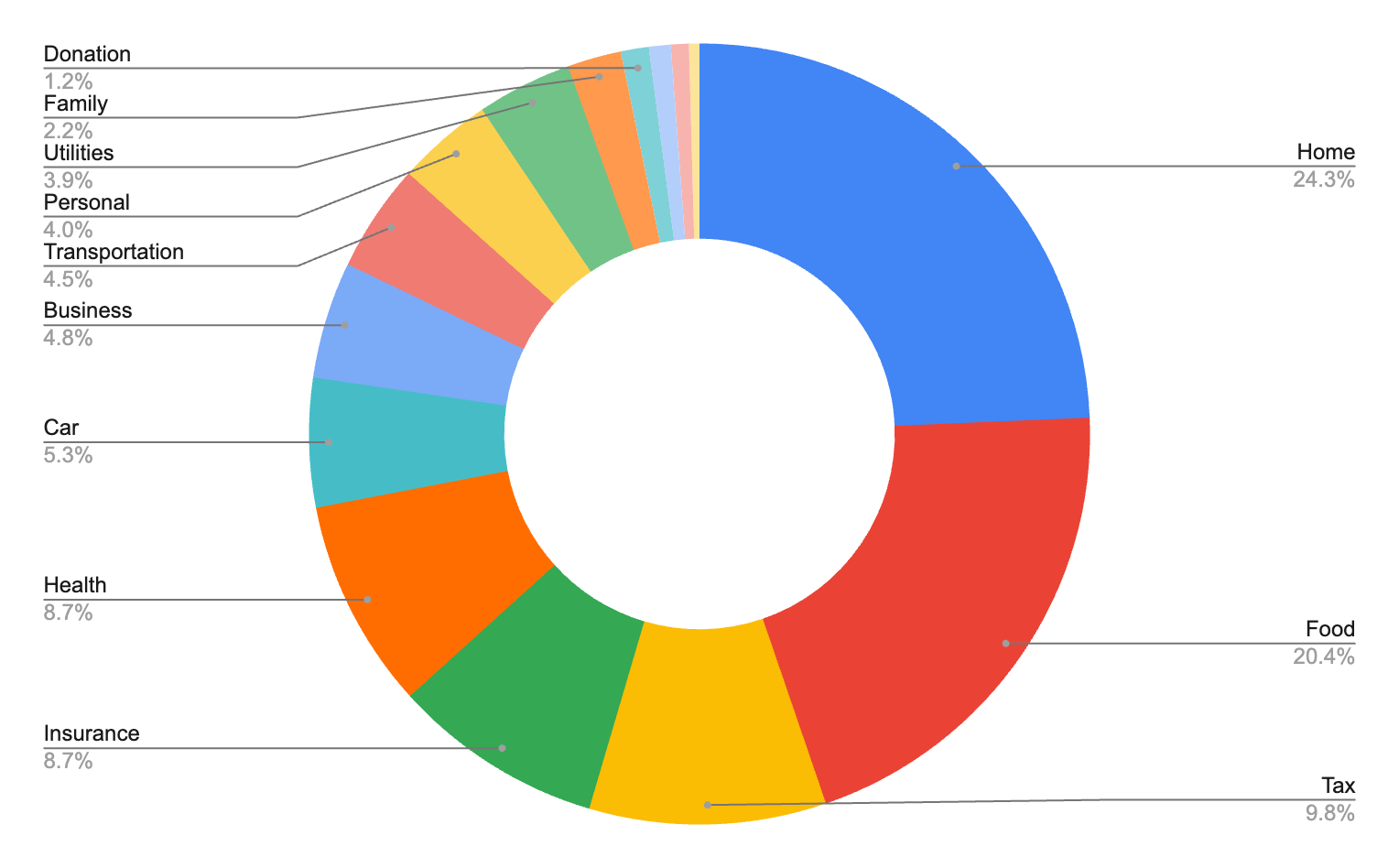

Spending breakdown

In February I spent a total of $3,698. Rent and food took the top two spots in my overall expenses, and income tax and insurance trailed in third and fourth place.

Food expenses came up to over $750. Though February’s food spending was lower than in January (I spent over $1,000, yikes!), it’s still an uncomfortably high number for me.

Looking through the breakdown by subcategory, I can pinpoint exactly where the problem was – indulging too much in nights out at a restaurant or a bar.

These nights out are usually when I meet up with friends or go on dates with my partner. I do like to go to a nice restaurant but maybe limiting it to once or twice a month might be more sensible at the moment given my current uncertain income.

Learning how to optimise my time better

February seemed to have run away from me. I wanted to work on a few things related to this blog but it ended up falling by the wayside.

I could have planned my schedule a little better. But truth be told, I didn’t realise how busy my schedule would get in the month.

When I look back on my Google calendar each week, I can see that I have been putting my time to use. I’ve got clients’ work, prospects, exercise and family time all scheduled in

The question now is whether I could have been putting that time to better use.

I feel unaccomplished despite being “busy”. There were many days I felt mentally scattered scrambling to tick off things on my never-ending to-do list. Consequently, it always seemed there was never enough time for everything.

I’ve read enough productivity tips to know that I need to prioritise the 3 most important tasks for each day.

But sometimes, the day just gets away from me and I end up working on impromptu tasks that weren’t that urgent or important. There were many days like that in February.

In March, I hope to get closer to solving these two time-management problems I seem to have:

- How to better prioritise tasks and allocate time properly to them

- How to optimise my time better

Switching from expense tracking to budgeting

I don’t budget, but I track my expenses.

If you’re reading this thinking, “Aren’t those two things the same?”. Most people use these two words interchangeably, but they refer to two very different actions.

Budgeting involves planning and setting limits on your spending. Think of it as a framework for allocating your money to different things in your life. So you decide in advance how much to allocate to things like rent, utilities, groceries, entertainment, etc based on your income and spending priorities.

Meanwhile, expense tracking is just noting down what you spend on and how much. It’s more to give you a clear picture of where your money is going. It is retrospective.

I get valuable insights into my spending pattern by tracking my expenses. But I often find myself on the backfoot reacting to what I’m spending on rather than proactively addressing my spending priorities.

Last year, I set a high-level target for my overall spending each month in an attempt to have a little more foresight so I can manoeuvre through my finances better. But in hindsight, it wasn’t a very effective strategy to stay on budget.

You might have thought that after all these years of being immersed in all things personal finance, I’d be a budgeting pro by now. But I let my procrastination get in the way.

Not anymore!

With an irregular income, it’s clear to me that having a budget is even more crucial now.

You know what they say… proper planning and preparation prevents piss poor performance (try saying that ten times faster).

I’m still working on my budget for this year (forgive me, future Nicole, I procrastinated again!). Once it’s completed, the aim is to stick to it as closely as I can.

The fun part is revamping my expense tracking sheet so that it includes a budgeting element and some other new features that I am geeking out on. The hope is that the new system can give me more actionable insights to guide my financial decisions effectively.

It’s all trial and error, so I’m tweaking and experimenting as I go along. I always believe that we’ll never truly perfect our finances, it’s an iterative process where you uncover what works best for you at every stage in your life and adapt accordingly.

Hopefully, this sentiment liberates you from inaction, too. After all, it’s the proactive steps you take towards financial stability that truly matters.

Did February also leave you in the dust? What budgeting method do you use to manage your spending? Feel free to share your thoughts in the comments, or follow me on Facebook, Twitter, or Instagram.